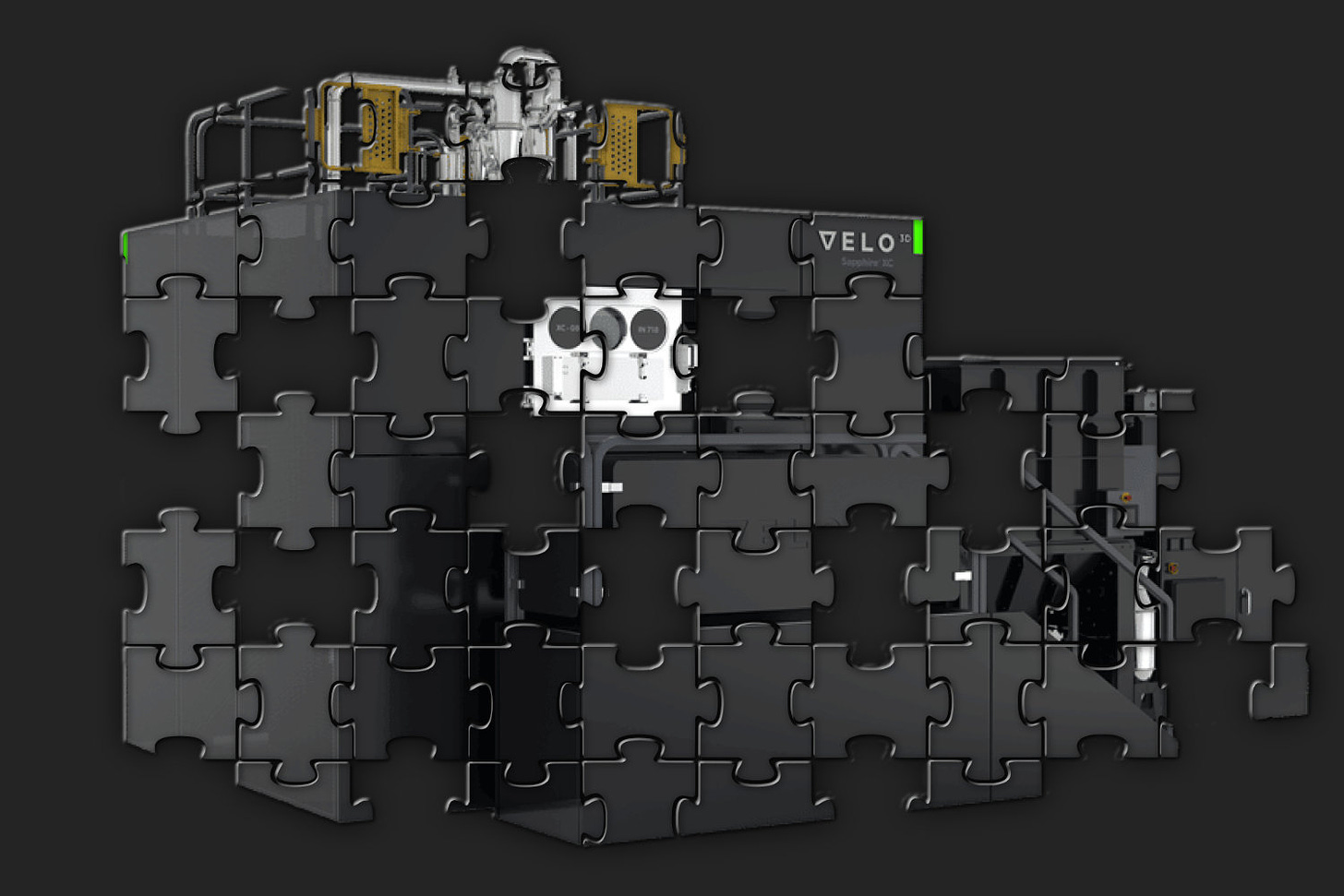

The puzzling story of Velo3D

How one of the most innovative AM companies dropped to the level of a penny stock

It’s really hard to explain.

While history knows several cases of AM companies that quickly fell from the top of the industry, they usually:

had technology that didn’t stand the test of time (Z Corporation, Solidscape),

were simply bad and operated purely on hype (Cubify, Robo 3D),

released new but highly disappointing products (MakerBot, Zortrax),

or were simply overtaken by competitors (EnvisionTEC by Formlabs, Ultimaker by Prusa, Prusa by Bambu Lab).

The case of Velo3D is different. The company developed a unique, proprietary technology, gained market recognition, and its products reached top industrial production clients. It obtained all the necessary certifications and approvals for implementation in strategic sectors of the country. It entered the stock market with a bang, reaching an incredible valuation of $2.24 billion.

And then, it all suddenly crumbled like a house of cards.

Or rather — it’s like someone was painstakingly setting up a complex domino line, and suddenly, the tiles start falling in the middle of the process. Everything has to be started over from scratch.

That’s roughly what Velo3D’s current situation looks like.

Its founder, Benny Buller, has been out of the company for over half a year.

After receiving sequential letters from the NYSE regarding non-compliance with its standards, the company was delisted from the stock exchange this week.

As a result, it moved to the much less prestigious OTCQX market, and its stock valuation has plummeted to an embarrassing $5 million.

For comparison, the average NBA player made $10,277,000 USD for the 2023–24 season.

This was supposed to be a beautiful story, but instead, it’s turned into a real tragedy.